Where Premium Returns Meet Personalized Service

You’re eligible for BCU membership! Your money is waiting to grow with these special offers.

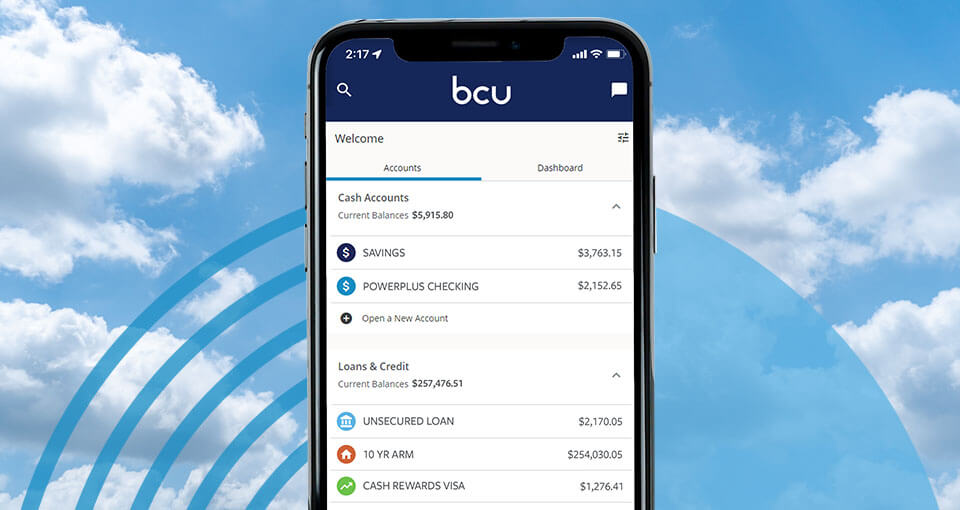

BCU is your local, full-service credit union offering

exceptional rates, valuable rewards, and personalized service across deposits and loans.

Just around the corner — and always in your corner.

Branch Hours: Monday-Thursday 9am-5pm | Friday 9am-6pm | Saturday 9am-1pm Central Time.

Get a checking account that earns a rate 99x higher1 than national big banks.

With a highly-rated mobile app and more than 360,000

members nationwide, BCU is a name you can trust.

Frequently Asked Questions

-

What is a Credit Union?

A credit union is a not-for-profit, cooperative financial institution owned by its members. Credit unions offer the same services as banks, but the profit cycles back to members instead of stockholders. As a result, members benefit from higher earnings on deposit accounts, lower rates on loan products that typically have lower to no fees—bringing savings to the entire membership.

-

Who can join?

See if you qualify based on one or more of the following criteria:

Employment-based eligibility: You are a permanent, temporary or contract employee of one of the several elite employer groups offering the Credit Union’s services as a valuable employee benefit.

Community-based eligibility: You live or work in one of six local community charter counties: Lake, McHenry, DuPage, Kane or Cook (north of 95th Street on the south side of Chicago) County in Illinois, or Kenosha County in Wisconsin.

Family-based eligibility: You are the immediate or extended qualifying family of an existing member related by blood, marriage, fostering or adoption. Eligible family members include: spouses, parents, children, siblings, domestic partners, grandchildren, grandparents, aunts, uncles, nieces, nephews, and cousins.

Life. Money. You.® eligibility: You are a subscriber of the Life. Money. You.® Financial Well-Being program. -

How do I join the Credit Union?

-

What if I open an account and then move or leave my company?

Once a member, always a member! Benefits of Credit Union membership will always be available to you and your family, no matter where life takes you. Relocating to a new area? No problem! Changing jobs? The Credit Union goes with you. Retiring? We're Here Today For Your Tomorrow. Our commitment to your financial well-being is truly a lifelong promise. We’re accessible 24 hours a day using our digital banking services and have many members who never set foot in a branch.

-

What benefits come with Credit Union membership?

Our members are the reason we exist and is why we help our members maximize their benefits with products and services like:

- Access to your payroll funds up to a day early with Enhanced Direct Deposit™

- High-interest Checking with ATM fee reimbursement

- Low rate loans for homes, vehicles, college tuition and more

- Easy access to your free online credit score with SavvyMoney®

- Complimentary financial education resources provided by Life. Money. You.®

-

Disclosure

1. Annual Percentage Yield (APY). Dividends earned for the first 12 months from membership open date. Earning example based on a $15,000 daily average balance. Assume Level 2 qualifications are met with earning 8.00% APY for 3 months after account opening and 4.00% APY for remaining 9 months after account opening. Membership must be opened between 7/1/2025 and 12/31/2025. Level 1 earns 4.00% APY, Level 2 earns 8.00% APY for the first 3 months. After that, balances up to $15,000 earn the higher rate, and over $15,000 earn the lower rate. The 3-month introductory period starts the month the membership is opened and ends on the last day of the 4th month. See rate sheet or website for current rates. All requirements must be met for all three months to qualify for the higher APY. Visit BCU.org/PPC or speak to a representative for more details. Calculation is based on the national deposit rate for interest checking of 0.07 as of 6/16/2025. Source: S&P Capital IQ Pro; SNL Financial Data. Calculations: FDIC. Visit www.fdic.gov/national-rates-and-rate-caps to access published information.

2. Promotional rate accurate as of 7/1/2025 and subject to change. Offer available to BCU members, who fund the 9-month certificate with new money. New money is defined as money not on deposit with BCU at or within 30 days, which had not previously been on deposit in the 90 days prior to the opening of the new share. The minimum balance required to open a Certificate Account and obtain the above promotional annual percentage yield (APY) is $500. Certificates with a balance of $0 will be closed 10 days after the open date. The APY is based on the assumption that dividends will remain in the account until maturity. A penalty may be imposed for early withdrawal. Penalty may reduce earnings.

3. Rates and Annual Percentage Yields (APYs) accurate as of 7/1/2025. Offer valid for new Money Market Special account with a minimum balance of $15,000 in new money. New money is defined as money not on deposit with BCU at or within 30 days, which had not been on deposit in the 90 days prior to the opening of the new share. This is a tiered rate account. Balances of $15,000 and greater will earn the introductory rate of 4.00% APY for 6 months from the account open date. The 6-month introductory rate period begins the month the account is opened and ends the last calendar day of the 6th month. After the 6-month introductory period, balances of $15,000 and greater will earn the rate of 1.35% APY. Balances below $15,000 will earn the stated lower rate of 0.05% APY. The rates and APYs are variable and may change. For complete details, see the Service and Fee Schedule in the BCU Consumer Member Service Agreement at BCU.org for a list of fees applicable to this account.