Debit Card

How to activate your Debit card

By Phone

In Digital Banking

Why wait?

You can safely begin using your card before it arrives in the mail. Here’s how:

Ways to pay

Digital

• Quick, contactless checkout using your device

• Your card number is never stored on your device

Physical

• Use to grab cash at the ATM

• You’re covered if your card is ever lost or stolen with built-in fraud protection

• Streamline budgeting and easily track spending

• Use contactless chip and tap-to-pay for a quick and secure checkout

No matter how you pay, enjoy these benefits

Zero Fraud Liability

More ATM Locations

Find one today.

Contactless Transaction

Here's how.

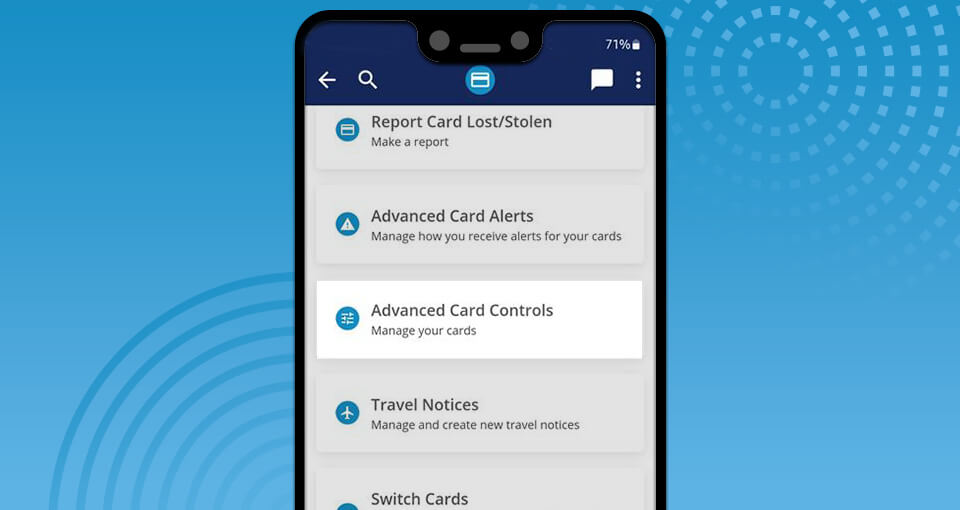

Take Charge With Card Controls

Set alerts to stay on budget. Plus, lock and unlock your card whenever you need to. Learn how.

Frequently Asked Questions

-

I’ve added my Debit card to my Digital Wallet. How do I pay?

It’s quick and easy, simply follow these steps. Make sure your BCU Debit card is set as your default card in your wallet.

At the checkout, look for the contactless symbol.

On your phone or wearable device, look for the wallet app.

Hold your phone near the reader (you may need to double click). Wait for the check mark for completion. Easy as 1, 2, 3!

Paying on an app or a website? Look for this symbol.

No need to create an account or fill out forms! -

How can I use my new card?

You can tap, insert, or swipe your card to make in-store purchases! For online or remote purchases, you can find all your card information housed on the back for ease of use and security, including your card number, expiration, and security code.

-

Why does my card take 7-10 business days to arrive?

We know getting your card quickly is important! Processing moves fast, and while mail delivery takes a bit longer, cards are delivered within 7-10 business days.

In the meantime, access funds instantly and start making secure payments from your phone—even before your physical card arrives. Set Up Digital Wallet. -

What do I do if I need my card sooner?

You can add your card to your Digital Wallet anytime! Here’s how:

Step 1

Log into the BCU Mobile App. Navigate to your Checking share or Credit card and select Card Services. Select Add to Wallet and proceed to authorization3.

Step 2

Select your device, read and agree to the Term & Conditions, and verify your card.

Step 3

Success! You can now pay online, in stores, and on apps. Skip the wallet and hold your phone or smartwatch near the payment reader to complete your transaction.

-

My card is damaged. How can I request a replacement?

We can help! Call 800-388-7000 for immediate support.

-

What are the spending limits on my card?

Standard daily Debit card limits include $1,210 at the ATM, $2,000 using your PIN, and $10,000 with a signature. Need an increase? No problem! Here’s how.

*Visa’s Zero Liability Policy does not apply to certain commercial card and anonymous prepaid card transactions, or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use. Contact BCU for more detail.