Earn up to $745* with

PowerPlus™ Checking

Why BCU?

Unlike a bank, the Credit Union is a not-for-profit organization, dedicated to empowering your discovery of financial freedom. That’s why you’ll find better rates, fewer fees (and no fees when possible), higher earnings, and more innovative products and services than you’d get at other financial institutions.

BCU is one of the nation's Top 100 credit unions, serving over 360,000 members in the United States and Puerto Rico. You’re just moments away from a better way to bank. Join today!

Higher Rates

Earn up to 8.00% APY on balances up to $15,000.*

Fewer Fees

Up to $20/month in ATM fee refunds* and no monthly maintenance fees.

Earlier Payday

Access your money up to two days ahead of your scheduled payday.2

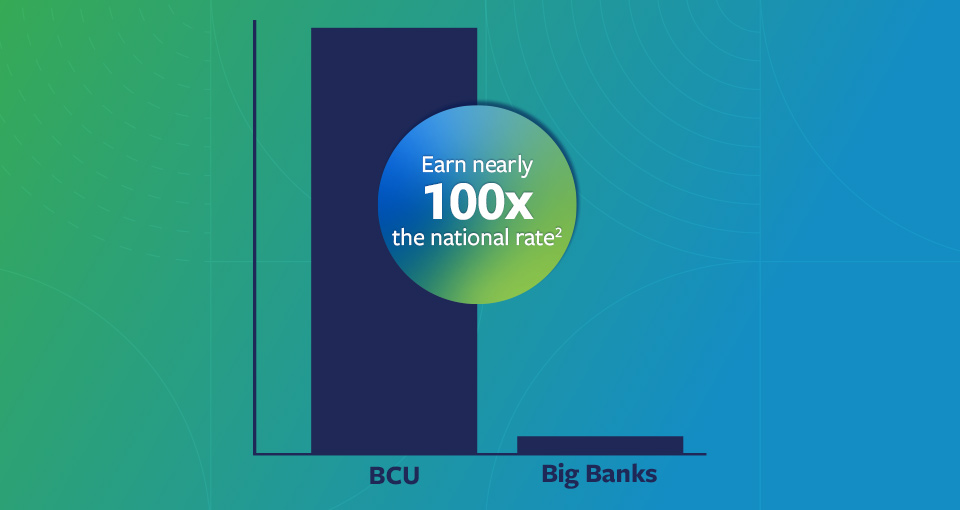

Get a checking account that earns nearly 100 times higher2 than rates at national big banks.

BCU offers membership to subscribers of Life. Money. You.®, a free financial well-being program.

To open an account, follow these simple steps:

Step 2

Step 3

Ways to qualify:

⦁ Commit to your financial well-being and subscribe to Life. Money. You. (it’s free)

⦁ Permanent, temporary or contract employee of one of BCU’s employer groups, OR

⦁ Live or work in northern Illinois, southern Wisconsin, or the island of Puerto Rico

⦁ Immediate or extended family of a BCU member

-

Disclosure

*Annual Percentage Yield (APY). Dividends earned for first 12 months from membership open date and assume no withdrawal activity during that period. Earnings example based on a $15,000 daily average balance. Assumes Level 2 qualifications are met with earning 8.00% APY for first 3 months after account opening and 4.00% APY for remaining 9 months after account opening.

PowerPlus™ Checking

1Membership must be opened between 7/1/2024 and 12/31/2025 to receive this promotional offer. The 3-month introductory period begins the month the membership is opened and ends on the last calendar day of the 4th month. During the 3-month introductory period Level 1 will earn 4.00% APY and Level 2 will earn 8.00% APY. After the 3-month introductory period, balances up to $15,000 will earn the stated higher rate and the portion of the balance over $15,000 will earn the stated lower rate. See rate sheet or website for current rates. The member account must meet all requirements to achieve either Level 1 or Level 2 for all three months to be eligible to receive the respective higher APY.

To earn monthly dividends and reimbursements of other banks’ ATM surcharge fees up to $20.00 per month, your account must meet all three of these requirements to qualify for Level 1 or Level 2. Please note, Level 1 ATM surcharge fees are covered up to $10.00 per month and Level 2 ATM surcharge fees are covered up to $20.00 per month.

To achieve Level 1, you must have monthly direct deposits totaling at least $1,000 into your PowerPlus Checking account on an ongoing monthly basis, enrollment in eStatements and completion of at least fifteen (15) qualified transactions.

To achieve Level 2, you must have direct deposits totaling at least $3,000 into your PowerPlus Checking account on an ongoing monthly bases, enrollment in eStatements and completion of at least thirty (30) qualified transactions.

Qualified transactions include any combination of the following: BCU Debit Card PIN, Debit Card Signature, credit card purchases, Online Bill Pay or ACH payments, which will apply toward the monthly requirements in the month they post to your account. Credit card transactions that post on the last day of the month will be applied toward the following month’s transaction total. Accounts not meeting all monthly requirements will not earn dividends and will not receive reimbursements of other banks’ ATM surcharge fees and will not be eligible for the increased APY offer during the introductory period.

Rate accurate as of 2/1/2026. The dividend rate and annual percentage yield (APY) may change at any time. Balances up to $15,000 will earn the stated higher rate and the portion of the balance over $15,000 will earn the stated lower rate. See rate sheet or website for current rates. There is no minimum balance required to earn dividends. Dividends are paid monthly and calculated based on the average daily balance method. Fees may reduce earnings.

PowerPlus Checking is available as a personal account only and is limited to one account per member. When Opted In, if you do not have sufficient available funds in your checking account to clear a presented item, funds may automatically transfer from your savings or money market share and may count towards withdrawal limitations for that savings or money market share (Electronic funds transfers from savings and money market shares, which include overdraft transfers are limited to six per month). Each electronic funds transfer in excess of six per month is subject to a $3 excessive withdrawal fee. See Service Charge and Fee Schedule in Consumer Member Service Agreement for further details. PowerPlus™ Checking is a trademark of BCU.

2. Calculation is based on the national deposit rate for interest checking of 0.08 as of 6/17/2024. Source: S&P Capital IQ Pro; SNL Financial Data. Calculations: FDIC. Interest checking rates are based on the $2,500 product tier. Visit FDIC: National Rates and Rate Caps to access published information.